Tire recycling company Ecolomondo Corporation (ECM-X) processed a record 68 tonnes of rubber crumb over a five-day period at its Hawkesbury, Ont.-facility in January, reaching a milestone on its path to commercialization.

Over the week of Jan. 12, the Montreal-based company processed five double batches of used tires, each batch weighing approximately 6.8 tonnes of rubber crumb. The result was approximately 27 tonnes of carbon black, a powder used to make tires, plastics and coatings.

It was the first time Ecolomondo processed tires for five consecutive days, its chairman and CEO Eliot Sorella told Sustainable Biz Canada in an interview. The previous record was two days in a row, he added.

Starting commercial-level operations of the Hawkesbury facility, located between Ottawa and Montreal, is a major target for the company this year. The Hawkesbury facility is expected to process a minimum of 14,000 tonnes of tires per year with its two reactors.

“We’re certainly getting there,” Sorella said about the commercialization of Hawkesbury. “Our sales are increasing.”

It is expected to be a stepping stone for Ecolomondo’s larger site in Shamrock, Texas, which is designed to have approximately three times the processing capacity of its Canadian counterpart.

Ecolomondo's recycling technology

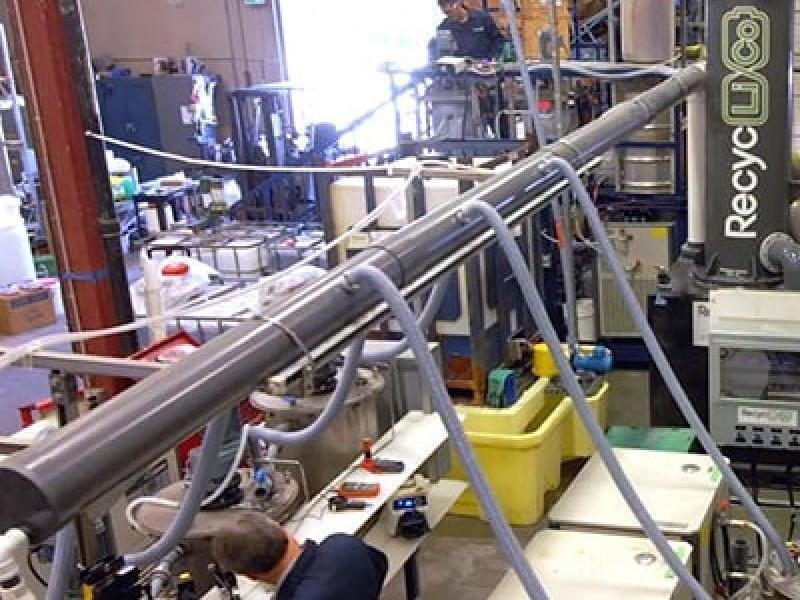

To help manage the millions of tires that enter the waste stream in Canada every year, Ecolomondo is aiming to turn its proprietary technology, called the Thermal Decomposition Process (TDP), into a full-scale business. Scrap tires are shredded and heated to extract the rubber, steel, oil, gas and carbon black which can be reused, supporting the circular economy.

TDP outputs a blend of materials that can be recycled. The carbon black, for example, can be used in the plastics industry or to make new tires. The oil and gas can be used to power the reactors in an Ecolomondo facility.

Each TDP reactor can offset over 10,000 tonnes of carbon dioxide emissions per year or 90 per cent of the carbon emissions to make a tonne of carbon black compared to producing a fresh batch, Ecolomondo says in a technology overview.

Ecolomondo sources its tires for the Hawkesbury facility from companies in the Ottawa Valley, Sorella said, such as transportation businesses.

Today, the company generates just under $300,000 in revenue per month from the Hawkesbury site, he said. Ecolomondo hopes to begin commercialization of the Hawkesbury facility this year and bring in approximately $1 million in revenue per month.

To support its development, Ecolomondo reached an agreement in principle for $2.7 million in financing with Export Development Canada in January.

Ecolomondo's plans for Texas, European sites

After Ecolomondo reaches commercialization of its Hawkesbury facility, its next major project is to be the site in the northern Texas city of Shamrock. It is designed to process approximately 50,000 tonnes of tires per year with six TDP reactors, yielding approximately 15,900 tonnes of carbon black and 5,400 tonnes of steel.

“We were waiting for Hawkesbury to start commercializing so our process would have been truly validated,” Sorella said.

Ecolomondo owns the land proposed to host the facility, he noted.

Sorella expects construction will take approximately 18 months and anticipates commercial operations can begin by early- to mid-2028.

Outside of North America, Ecolomondo has its sights set on Europe. The company signed a letter of intent with Spanish company Aresol in 2024 to collaborate on the development of a 20,000-tonne-per-year tire recycling facility in Valencia.

After that, Ecolomondo has plans for three more facilities in Europe. Compared to North America, governments on the continent offer more generous subsidies and have more stringent regulations on manufacturers using recovered materials, he explained.

“The market is much more advanced in Europe when it comes to our industry,” Sorella said.