The prospect of lower natural gas prices will appeal to most consumers. But not all consumers should cheer. Companies with fixed procurement contracts could face downside risks from lower prices if they do not take timely action to limit their losses.

Will natural gas prices go down?

Markets are notoriously difficult to predict. However, since spiking in the spring of 2022, gas prices have been trending lower. There are currently no fundamental factors in play to suggest this trend will be reversed.

Warm weather in North America and abroad last winter lowered demand – and prices – for natural gas. European efforts to reduce dependency on Russian gas also destroyed demand, and helps explain the momentum for collapsing gas prices in 2023.

The hot summer has provided some relief for gas producers. The electricity needed to cool down buildings has driven up consumption from the power generators that use natural gas. However, the relief for producers may only be temporary. Gas prices are expected to drop further once maximum storage capacity has been reached this summer or later this fall.

What role does storage play in setting gas prices?

Natural gas is stored in large underground reservoirs when demand is low, so sufficient volumes are available to draw down in cold months when demand rises. This process helps to smooth out production and price volatility over the course of a year. Still, if storage levels are high and demand remains soft, prices can test new lows.

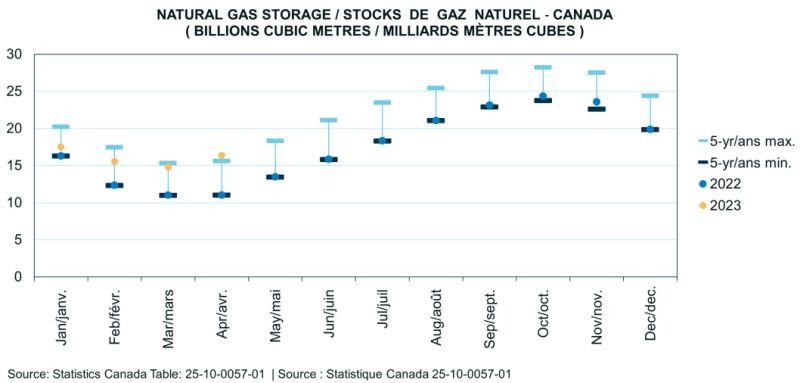

Reports of Canada-wide storage levels traditionally lag current activity. What is known as of April 2023 however, is that Canadian storage levels exceeded five-year maximums. The widely-held assumption is that actual storage levels have continued this higher trend.

Evidence for assuming higher storage levels comes from Ontario. Natural gas storage in Ontario, as of August 1st, was sitting at 241 petajoules. This was at a much higher level than is generally seen at this time of year.

Hot summer weather eventually gives way to lower fall temperatures. Traditionally, with cooler weather, natural gas storage goes up. But if storage is already at capacity, there is no place for that gas to go. The likely outcome from having high summer storage is further depressed gas prices.

What actions could gas consumers with fixed contracts take?

Many natural gas contracts have a provision for “load balancing”. In these contracts, consumers commit to purchase a set volume of gas, for a set price, over the contract term. If their consumption varies from the volumes they have contracted to buy, the customer needs to “balance out” their consumption to match the volumes in the contract. By the end of the contract term, they must either purchase the additional volumes they have consumed or they must sell any volumes they have not consumed.

Based on 360 Energy’s research, there are currently many customers in Ontario who have unconsumed gas to sell. Widespread sales in conjunction with contract term end dates could depress gas market prices. Consumers with surplus volumes to sell could get substantially less than they paid to acquire those volumes.

It is always a good time for companies that have procured gas under one of these contracts to take stock of where their gas consumption stands. If a company can reasonably anticipate having surplus gas to sell at the end of their contract, they need to decide whether to sell that surplus now or wait until the end of the contract. It might be better to act early as there appears to be a strong chance that gas prices will trend lower this fall.