Exro Technologies Inc. (EXRO-T) announced it has laid off approximately 60 workers, including most in its Cell Driver and Coil Driver units, as it negotiates a credit facility and considers selling intellectual property as part of a strategic review.

The Calgary-based company, which develops and manufactures power electronics for electric vehicles (EVs) and energy storage equipment, has struggled as of late. It has run at a loss for several quarters in a row, reporting a net loss of $78.9 million in Q2 with revenue of $2.9 million. Exro also finished the strategic wind-down of its Asia-Pacific operations that quarter.

In a management discussion and analysis for Q2, the company blamed economic headwinds such as tariffs that have contributed to a slowdown in the auto sector, hindering its business.

In May, it announced a funding commitment from a long-term institutional shareholder to provide up to US$30 million through a loan facility. The funds would sustain Exro’s operations as it worked through a business plan and a strategic review that would explore opportunities such as partnerships, capital restructuring and a merger and acquisition.

The company said Wednesday morning the strategic review process is focusing on the potential sale of its intellectual property and technology, and possibly certain limited components of its business.

Exro is also negotiating “revised milestones” to access the loan facility “which reflect Exro's updated cost reduction and repositioning initiatives.” Continued access, the company says, will be in part dependent on “the outcome of certain asset sale discussions.”

Exro delayed its annual general meeting scheduled for Friday; a new date has yet to be announced.

As of Wednesday morning, Exro's shares were trading at $0.02, down 60 per cent from Tuesday's close.

Exro's operational troubles in 2024 and 2025

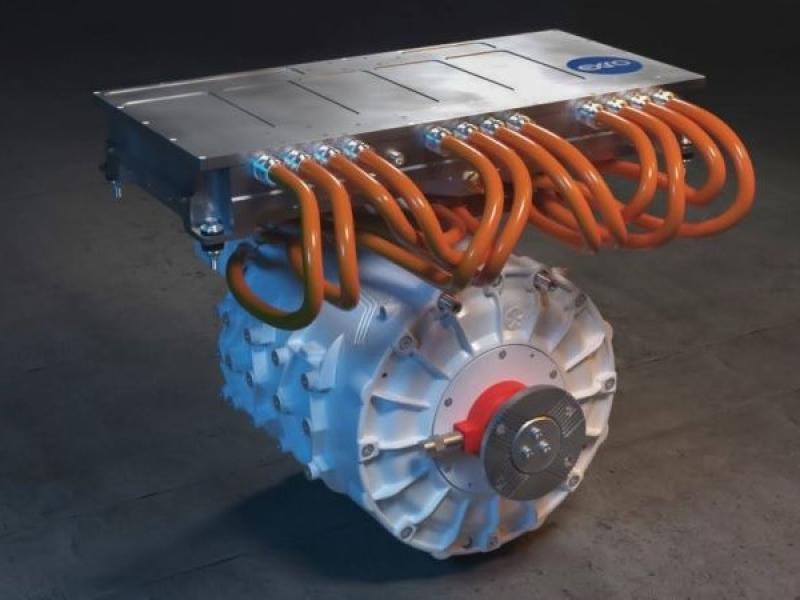

Though Exro hit a major milestone last year when it unveiled the integration of Coil Driver into Stellantis’ EV powertrains, the company shared the good news with the bad.

In a shareholder letter published January 2024, Exro’s CEO Sue Ozdemir noted the slowdown in the EV sector that held back expectations for growth. She expected Exro to cross over $200 million in revenue that year, an ambition it was far from achieving.

In Q3 2024, the company recorded a net loss of $226 million, primarily from an impairment expense of $211 million on the write-down of assets from its acquisition of SEA Electric in 2024.

She told Sustainable Biz Canada in an interview the transition to electric transportation would be arduous, a disruptive switch that would come with peaks and valleys.

Ozdemir referred to such challenges in a letter to shareholders published in February, mentioning “numerous operational challenges” in 2024. Inching toward profitability was the goal for 2025, she said. Ozdemir also noted Exro would right-size its operations.

Progress on its commercial vehicle programs with original equipment manufacturers piloting Coil Driver was cited by Ozdemir as positioning Exro for growth in the commercial industrial truck sector. The company secured a paid pilot program with a top manufacturer, with the aim of securing production for 2026.

She said development in the passenger vehicle sector continued, which would position Exro for expansion in battery-electric and hybrid vehicles. Its energy storage division Cellex was also said to be gaining traction, with projects set to deliver in 2025.

As of Q2, Exro held on to $3.56 million in cash and cash equivalents, with a working capital deficit of $20.8 million.

“Additional financing will be required over the next twelve months to fund operating activities and strategic initiatives,” Exro said in its latest financial results.