NU E Power Corp. (NUE-CN) intends to sell its equity interests in three Alberta solar and energy storage assets, its first project sale as the Calgary-based company transitions into a developer.

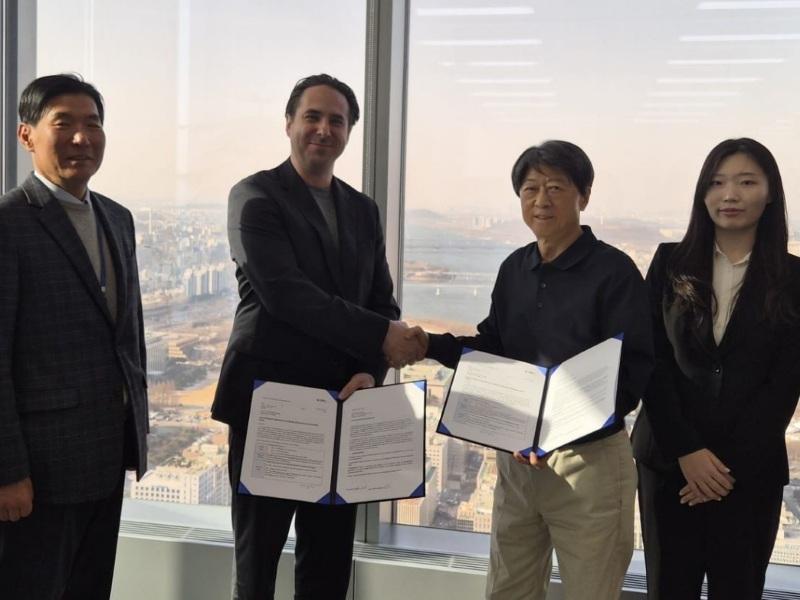

Last week, NUE entered into a letter of intent (LOI) with South Korean private equity firm Green Harbor Partners Corp. to consider a transaction for the Lethbridge Two, Lethbridge Three, and Hanna Solar projects. The combined power generation capacity of the projects is planned as over 452 megawatts (MW).

NU‑E controls the development interests in the projects, its CEO Broderick Gunning told Sustainable Biz Canada in an email exchange. The company has invested approximately $3.6 million into the three projects, it said in a release.

Gunning declined to disclose the expected value of the proposed sale, saying it will be decided by market demand and competitive processes.

“This decision reflects timing, discipline and capital efficiency,” he said of the planned sale. “The projects have reached a point where meaningful development value has been created through land control, interconnection progress and permitting work.”

NU E plans to develop renewables, electrical grid, natural gas, nuclear and battery storage projects to meet the uptick in electricity demand driven by data centres and artificial intelligence (AI).

The proposed transaction would also lay the basis for a partnership between NU E and Green Harbor on future renewable and hybrid power projects.

The three solar projects

Lethbridge Two and Three are expected to be adjacent to one another in their namesake county, located two kilometres south of the Lethbridge Airport. Lethbridge Two is planned as a 12.6 MW project, while Lethbridge Three is designed as a 140 MW installation.

The first energizations of Lethbridge Two and Three are scheduled for Q2 2026 and Q3 2027, respectively.

The Hanna project is planned as a 300 MW solar farm near its namesake town in eastern Alberta. NU E anticipates operations to begin in Q4 2027.

Battery energy storage is being “actively evaluated” for the three projects as part of NU-E’s broader hybrid power development strategy, Gunning said. Batteries, he continued, are becoming “increasingly essential” for price arbitrage and grid services, plus supporting AI and digital infrastructure loads.

The capacity of the batteries has yet to be determined. Gunning expects it will be based on factors such as market demand and grid requirements.

The LOI allows for NU E to retain a “meaningful” economic interest in the assets, with the option to retain a long-term royalty or carry.

The first of several phases for the LOI has interconnection approval from the Alberta Electric System Operator.

As the projects progress through development milestones, NU E expects to engage with strategic and financial partners to originate, de-risk and advance the projects. It then plans to partner with capital sources to optimize value and execution, Gunning said.

NU E has received strong interest in the three assets from buyers such as renewable power producers, infrastructure and energy transition funds, and strategic investors, he said. Growing electricity demand and Alberta’s market structure make the projects attractive, Gunning explained.

The potential NU E-Green Harbor partnership

Green Harbor is a renewable energy and infrastructure private equity firm that manages over 2.5 gigawatts of solar and wind assets in North America, South America and Europe.

With the South Korean firm, NU E looks to develop, finance and operate renewable and hybrid power projects.

The early iteration of the partnership is to start in Alberta. The goal is to then reach other markets such as Latin America, Southeast Asia, the Middle East, and North Africa, Jay Lee, the CEO of Green Harbor, said in the announcement.

NU E’s in-development projects include:

- the 200 MW Edenwold natural gas, solar and grid hybrid project in Saskatchewan;

- a 100 MW grid, solar, natural gas and battery energy storage project on a 200-acre site in Mongolia; and

- surveying greenfield land for a 100 MW solar and natural gas hybrid power generation site in Nigeria.