Next Hydrogen Solutions Inc. (NXH-X) is taking another step toward commercialization with plans to support production and sales of its NH-150 electrolyzers and development of a larger system, following a $20.7-million private placement.

The Mississauga-based electrolyzer designer and manufacturer announced the new funding in mid-December — an offering led by an affiliate of Toronto-based Smoothwater Capital Corporation, which is now Next Hydrogen’s largest shareholder.

In a release, Next Hydrogen said the financing “marks a decisive milestone” as it “transitions into a commercially focused, capital-efficient business delivering its next-generation alkaline electrolyzers to market.”

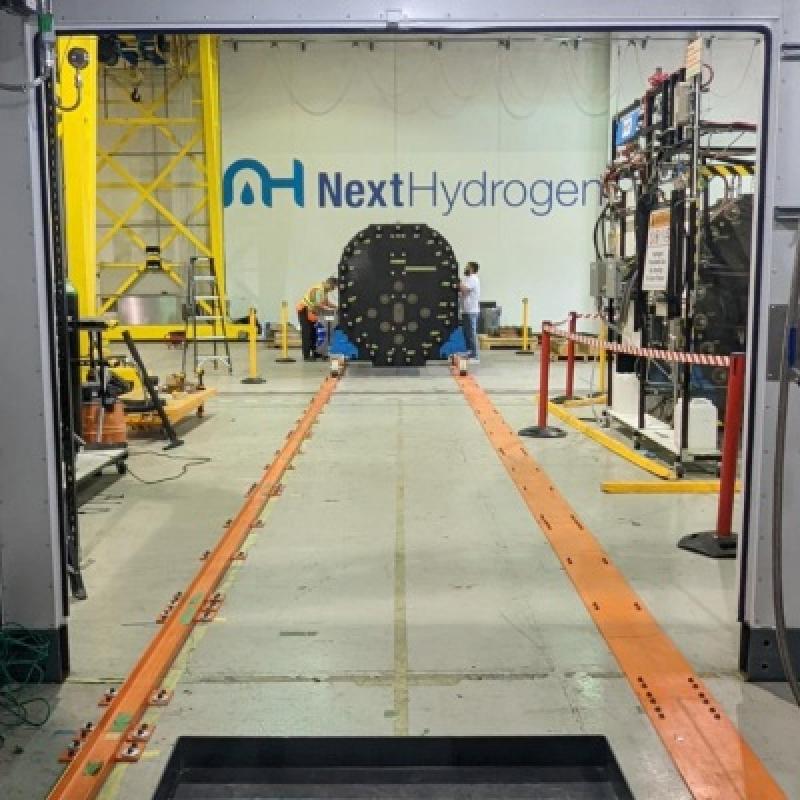

The NH-150 has already operated in a customer environment, Next Hydrogen said. The company’s electrolyzers, which split water into hydrogen and oxygen using electricity, are built to be powered by renewable energy sources. The electrolyzers are scalable and adaptable to a variety of industries and applications such as industrial decarbonization, energy storage and transportation, Next Hydrogen said.

“Our technology is designed for scalable deployment, direct intermittent renewable integration and long-term regulatory alignment, giving us confidence as we expand across multiple industrial applications,” Raveel Afzaal, president and CEO of Next Hydrogen, said.

Sustainable Biz Canada has reached out to Next Hydrogen for comment. We will update this article with any additional information if it becomes available.

Next Hydrogen to accelerate growth

Proceeds from the private placement will be used to support commercialization of the NH-150, for customer engagement and channel-partner relationships, Next Hydrogen said. The company can better reach Canadian and international customers with the funding, it added.

Additionally, Next Hydrogen plans to finance the development of its larger NH-500 system, which the company said is expected to unlock “substantial industrial opportunities.”

The hydrogen production capacity of the NH-150 or NH-500 systems has not been disclosed.

Though 2025 was not a strong year for the hydrogen sector according to the International Energy Agency, Next Hydrogen pointed to government support such as investment tax credits for clean hydrogen projects in Canada as a sign of a favourable regulatory environment.

Next Hydrogen’s board shuffled

Alongside the private placement, Smoothwater’s CEO Stephen Griggs has joined Next Hydrogen as executive chair. Next Hydrogen’s private placement advisor Paul Currie also joined the board of directors.

Griggs served as president and CEO of OPTrust before joining Smoothwater, and was also the executive director of the Canadian Coalition for Good Governance.

Currie is described as having extensive experience with large technology and manufacturing companies by Allan Mackenzie, a Next Hydrogen director. Currie’s background will assist the company as it commercializes, Mackenzie said.

Susan Uthayakumar, the chief energy and sustainability officer of real estate investment firm Prologis, left Next Hydrogen’s board following the closing of the private placement.

By focusing on designing high-performance electrolyzer modules and partnering with established channel partners and manufacturers, Next Hydrogen “will deliver superior products in a scalable, capital-light business model,” Griggs said.

The company’s current capacity

Next Hydrogen has 40 megawatts of manufacturing capabilities at its Mississauga facility, the company stated in an investor deck from February 2025.

In July, Next Hydrogen announced one of its electrolyzers was used for clean hydrogen fuelling at a major distribution centre in Ontario. It is designed to produce up to 650 kilograms of hydrogen per day to support fuel cell forklifts.

The investor deck highlights other testing and validation efforts with Casale SA, GE Power Conversion, Pratt & Whitney, Hyundai Motor Company and Kia Corporation. With an unnamed blue-chip customer, Next Hydrogen’s electrolyzer design architecture was used in a nuclear application, resulting in a $7.7-million contract.

With Chinese company Sungrow Hydrogen, Next Hydrogen forged an agreement to leverage Sungrow’s three-gigawatt manufacturing facility to deliver volume orders starting in 2026.

In its Q3 financials, the latest to date, Next Hydrogen reported revenue of $2.3 million and net income of approximately $100,000, compared to approximately $100,000 in revenue and a net loss of $3.9 million in Q3 2024.

Next Hydrogen held on to under $1 million in cash as of the end of Q3.